Germany, Europe’s strongest economy and a global model for labor regulation, has one of the most transparent and equitable wage systems in the world. The minimum wage in Germany plays a crucial role in balancing fair pay, inflation, and living standards. As of January 2025, Germany’s statutory minimum wage is €12.82 per hour, or roughly €2,161–€2,222 per month, making it one of the highest national minimum wages in the entire European Union. From students working part-time to permanent employees in large enterprises, understanding the Germany minimum wage per hour and how it impacts monthly earnings, tax deductions, and living standards is vital for workers, employers, and international professionals planning to move to Germany.

Key Highlights – Minimum Wage in Germany (2025)

- Current Minimum Wage: €12.82 per hour (€2,222/month gross)

- Annual Salary: €26,666 gross for full-time workers

- Upcoming Increases: €13.90 (2026), €14.60 (2027)

- Coverage: Full-time, part-time, temporary, agency workers & international students

- Exemptions: Apprentices, interns <3 months, volunteers, self-employed

- Take-Home Pay: €1,500–€1,600/month for single workers after taxes & contributions

- Sector-Specific Rates: Higher in healthcare, electrical, construction, and temporary employment

- Student Jobs: Part-time pay aligns with minimum wage (€12.82/hr); helps cover living expenses

- Compliance & Enforcement: Financial Control of Undeclared Work (FKS) ensures fair pay

- Penalties for Employers: Fines up to €500,000 for violations

- Importance: Ensures fair wages, protects workers, supports living standards, and promotes equity

What is the legal minimum wage in Germany (current)?

As of January 2025, Germany’s statutory gross minimum wage stands at €12.82 per hour before taxes. For a full-time worker employed for an average of 40 hours per week (173.33 hours per month), this translates into:

| Calculation | Amount (€) |

| Hourly rate | 12.82 |

| Weekly hours | 40 |

| Monthly hours | 173.33 |

| Monthly Gross Salary | €2,222 |

| Annual Salary | €26,666 |

- Statutory (general) minimum wage: €12.82 per hour (effective 1 January 2025). This is the general floor that applies across most sectors and employment contracts.

- The Minimum Wage Commission (Mindestlohnkommission) recommends adjustments; the government usually implements them by ordinance. The Commission’s periodic reviews led to the 2024 – 2025 adjustments.

- Some sector-specific or collective agreements set higher minimum wages for certain industries (e.g., temporary agency work). These sector minima remain in force when they are higher than the general statutory figure.

Why Minimum Wage Matters in Germany

The concept of minimum wage ensures that every worker receives fair compensation and that no employee is underpaid relative to their productivity or living costs. In Germany, before 2015, wages were predominantly determined by collective bargaining agreements. However, the introduction of the federal statutory minimum wage under the Minimum Wage Act (Mindestlohngesetz – MiLoG) made equitable pay a national priority.

Historical Evolution of the Minimum Wage in the Germany

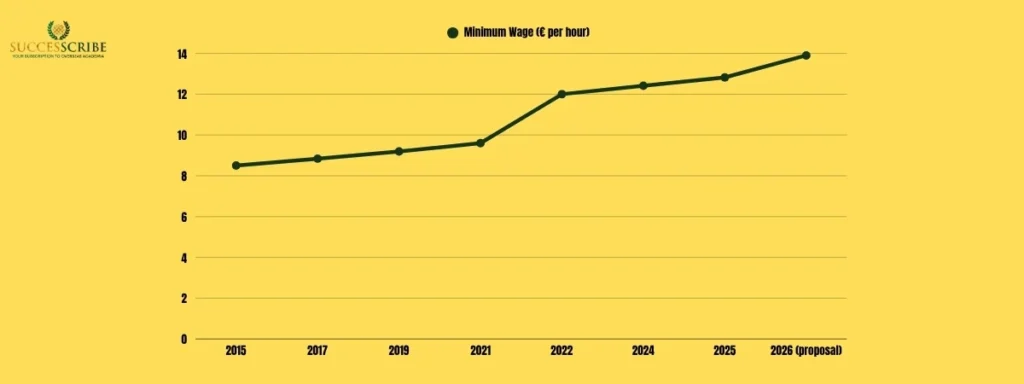

Germany’s minimum wage has evolved considerably since its 2015 inception:

| Year | Minimum Wage (€ per hour) | Percentage Increase | Remarks |

| 2015 | 8.50 | Introduction under Merkel’s coalition government | |

| 2017 | 8.84 | +4% | First adjustment by Minimum Wage Commission |

| 2019 | 9.19 | +4% | Inflation-based revision |

| 2021 | 9.60 | +4.5% | European pay alignment begins |

| 2022 | 12.00 | +25% | Major political increase |

| 2024 | 12.41 | +3.4% | Post-COVID recovery adjustment |

| 2025 | 12.82 | +3.3% | Current rate |

| 2026 (proposal) | 13.90 | +8.4% | Proposed increase |

Monthly and Yearly Earnings from Minimum Wage

Because people usually think in monthly pay, here are conversions based on common full-time hours. The numbers below are gross (pre-tax, pre-social contributions).

Assumptions

- Full-time week = 40 hours (standard assumption used here for comparability). Some employers/agreements use different full-time hours (e.g., 38.5 or 39), which changes monthly totals.

| Hourly rate (€/hr) | Weekly (40h) | Monthly (gross) = weekly×52/12 | Annual (gross) |

| €12.82 (statutory, 2025) | €512.80 | €2,222.13 | €26,665.60 |

| €13.90 (recommended 2026) | €556.00 | €2,409.33 | €28,912.00 |

| €14.60 (recommended 2027) | €584.00 | €2,530.67 | €30,368.00 |

Take-Home Salary in Germany: Understanding Your Real Income

When discussing the minimum salary in Germany, it’s important to distinguish between gross salary (the amount before deductions) and net salary (the amount you actually receive in your bank account each month). Different industries and experience levels can lead to variations in the Germany labour salary per month, with some sectors offering higher pay than the statutory minimum.

While the germany minimum wage per hour for 2025 is €12.82, the take-home pay that workers receive after taxes and social security contributions is considerably lower.

Key Deductions from Gross Salary

Every employee in Germany contributes to the country’s comprehensive social welfare system. The following deductions are automatically applied to the gross wage:

- Income Tax (Lohnsteuer): Progressive tax that varies based on your income level and tax class.

- Pension Insurance (Rentenversicherung): 18.6% of gross salary (shared equally between employee and employer).

- Health Insurance (Krankenversicherung): Around 14.6%–15.9% (also shared equally).

- Unemployment Insurance (Arbeitslosenversicherung): 2.6% of gross salary (shared equally).

- Long-Term Care Insurance (Pflegeversicherung): Around 3.4% (shared).

These deductions are automatically handled by employers through payroll systems.

Net Salary Example for Minimum Wage Workers

Let’s calculate the take-home salary for someone earning the minimum salary in Germany per month, working full-time (40 hours per week).

| Description | Amount (€) |

| Gross monthly salary | €2,222 (at €12.82/hr × 40 hours/week) |

| Total social contributions (approx. 20%) | €444 |

| Income tax (approx. 12% for single, no kids) | €266 |

| Estimated net salary (take-home) | €1,500–€1,600 per month |

So, although the basic salary in Germany per hour is €12.82, the net pay a worker actually takes home equals roughly €9.00–€9.50 per hour, depending on personal tax conditions and insurance coverage.

Factors Influencing Take-Home Pay

- Tax Class (Steuerklasse):

Germany has six tax classes depending on marital status, dependents, and secondary jobs. Married individuals or single parents may take home more than single workers without dependents.

- Health Insurance Choice:

Public vs. private health insurance contributions can affect deductions.

- State and Municipality Taxes:

Certain localities charge church tax (Kirchensteuer) if the worker is affiliated with a recognized church.

- Bonuses and Allowances:

Some employers provide meal allowances, transportation subsidies, or Christmas bonuses (Weihnachtsgeld) that improve overall net income.

| Employment Type | Gross Monthly (€) | Net Monthly (€) | Net Hourly (€) |

| Single, no children (Tax Class I) | €2,222 | €1,550 | €9.00–€9.50 |

| Married, one income (Tax Class III) | €2,222 | €1,750–€1,850 | €10.00–€10.50 |

| Student part-time (15 hrs/week) | €833 | €750–€800 | €12.50–€13.30 |

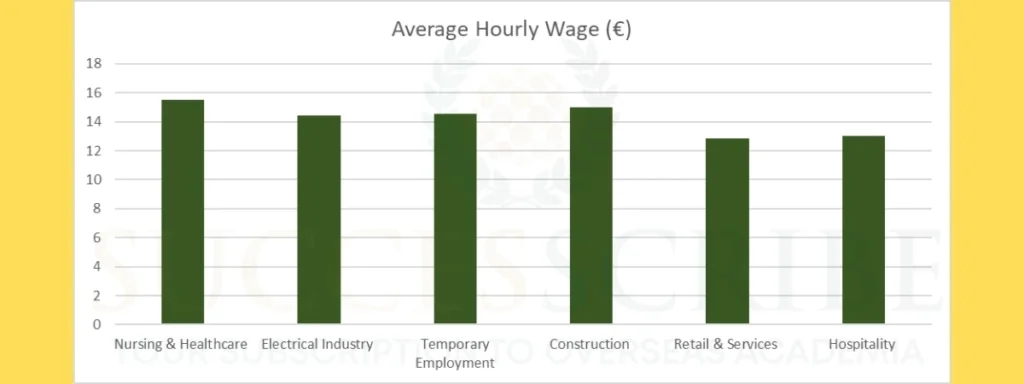

Sector-Specific Minimum Wages in Germany

Certain industries may offer higher pay than the basic salary in Germany per hour wage in Germany, depending on collective agreements and skill levels. While €12.82 is the national baseline, some industries – through collective bargaining – set higher minimums:

| Sector | Average Hourly Wage (€) | Comments |

| Nursing & Healthcare | 15.50 | Skilled professionals and night-duty staff |

| Electrical Industry | 14.41 | Reflects high vocational demand |

| Temporary Employment | 14.53 | Based on union negotiation (March 2025–Sept 2025) |

| Construction | 13.50–15.00 | Adjusted per region and skill level |

| Retail & Services | 12.82 | Base rate applies |

| Hospitality | 13.00+ | Varies seasonally per region |

This structure ensures that workers in physically demanding or skilled professions receive above-average compensation, maintaining Germany’s industrial competitiveness.

Who Gets the Minimum Wage in the Germany (and Who Doesn’t)?

Germany’s minimum wage law – the Mindestlohngesetz (MiLoG) – ensures that almost every employee working in the country receives at least the statutory minimum pay. However, there are a few exceptions and special categories where different rules apply. Understanding who qualifies and who is exempt helps both workers and employers stay compliant with German labour law.

Who Is Entitled to the Minimum Wage

The germany minimum wage per hour (currently €12.82 in 2025) applies to nearly all employees working under German employment contracts, regardless of nationality or industry. The law focuses on protecting fair wages for all kinds of workers, including foreign nationals, part-timers, and temporary staff.

Here’s who is covered:

- Full-Time Employees:

All full-time workers in both private and public sectors are legally entitled to earn at least the basic salary in Germany per hour set by law.

- Part-Time and Mini-Job Workers:

Even if you work fewer hours or have a mini-job (earning up to €538 per month as of 2025), you are still guaranteed the same minimum salary in Germany per hour as full-time workers.

- Temporary and Agency Workers:

Temporary workers, seasonal employees, and agency staff also fall under the MiLoG. In fact, many sectors have collective agreements (Tarifverträge) that ensure even higher hourly pay rates.

- Foreign Workers and Posted Workers:

Any person performing work on German soil – regardless of nationality – must be paid at least the German minimum wage. This includes foreign workers temporarily posted to Germany by international companies.

- Interns (in certain cases):

Paid internships lasting more than 3 months or those not part of a formal educational program must also meet the minimum salary standards in Germany.

Workers Who Don’t Get the Minimum Wage

While the majority of employees receive the minimum wage, there are carefully regulated exceptions based on age, type of work, and employment status. These groups are treated differently under the Mindestlohngesetz (MiLoG) or associated legislation.

| Category | Eligible for Minimum Wage? | Reason / Notes |

| Young workers under 18 years | No | They are not eligible unless they have completed formal vocational training. The law encourages education before full-time employment. |

| Apprentices (Azubis) | No (separate structure) | Apprentices are covered by the Vocational Training Act and receive wages according to training stage and sector-specific standards. |

| Volunteers | No | Since their work is non-remunerative and voluntary, the minimum wage does not apply. |

| Interns (under 3 months) | No | Voluntary internships under 3 months are exempt. Mandatory internships under study programs also fall outside wage coverage. |

| Long-term unemployed (first 6 months) | No | Workers re-entering the job market after 12+ months are exempt during the first six months to help stimulate hiring |

| Self-employed / Freelancers | No | They are considered independent contractors, not employees under German labor law. |

| Trainees under Vocational Training Act | No (specific pay levels apply) | Their pay rates are set through training agreements rather than minimum wage law. |

Minimum Wage in Germany for International Students

Germany is not only one of the best study destinations in the world but also one of the few countries that allows international students to work while studying. Earning alongside studies helps students manage their living expenses – and that’s where the minimum wage in Germany plays a key role.

As of 2025, the statutory minimum wage in Germany stands at €12.82 per hour, and this rate applies to international students just like it does to German nationals.

Can International Students Work in Germany?

Yes! International students are legally allowed to work in Germany under specific conditions:

- Non-EU/EEA students can work 120 full days or 240 half days per year without needing a separate work permit.

- EU/EEA students have no such restriction, but their work hours must not exceed 20 hours per week during the semester.

These rules ensure that international students focus primarily on academics while still being able to earn through part-time jobs.

How Much Can a Student Earn in Germany?

With the minimum wage of €12.82/hour (as of 2025), a student working part-time can earn a decent monthly income.

| Type of Work | Weekly Hours | Hourly Wage | Monthly Earnings (Approx.) |

| Part-time (10 hours/week) | 10 hrs | €12.82 | €512.80/month |

| Part-time (15 hours/week) | 15 hrs | €12.82 | €769.20/month |

| Part-time (20 hours/week) | 20 hrs | €12.82 | €1,025.60/month |

Students earning above €538 per month may need to pay taxes and social contributions, depending on their total income and job type.

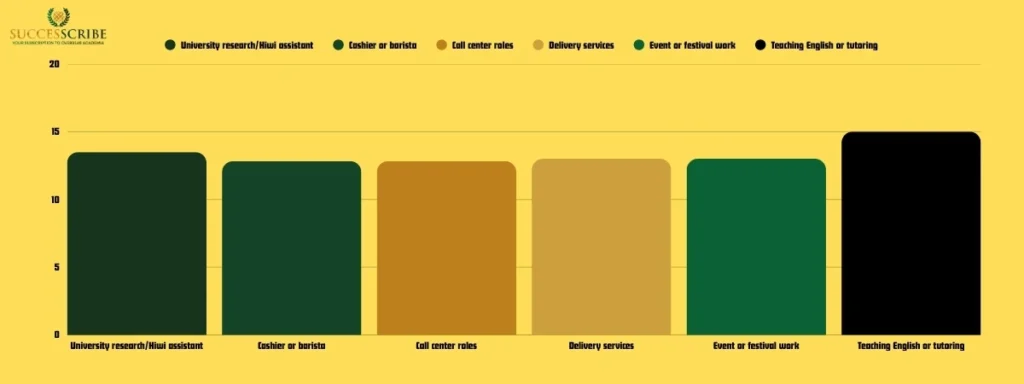

Typical Student Jobs and Wages

International students can find part-time employment across various industries. Many jobs offer pay equal to or above the Germany salary per hour threshold.

| Job Type | Average Hourly Pay (€) | Notes |

| University research/Hiwi assistant | 13.50–16.00 | Often higher than minimum wage |

| Cashier or barista | 12.82–14.00 | Common job for students |

| Call center roles | 12.82–15.00 | Communication-focused |

| Delivery services | 13.00–14.50 | Includes performance bonuses |

| Event or festival work | 13.00+ | Seasonal opportunities |

| Teaching English or tutoring | 15.00–25.00 | Based on qualifications |

Why the Minimum Wage Matters for Students

The minimum wage in Germany ensures that international students are not underpaid and can support themselves financially while studying. It promotes fair working conditions, equal pay, and helps students gain real-world experience without exploitation.

In addition, working part-time helps students:

- Improve German language and communication skills.

- Build professional connections for future full-time jobs.

- Gain insights into German work culture – a valuable experience post-graduation.

How Germany Ensures Fair Pay and Compliance

Germany takes the enforcement of its minimum wage laws very seriously. To maintain fair labor standards and protect workers from exploitation, the government has established strict systems to ensure that every employee – including part-time workers, apprentices, and international students – receives the legal minimum pay rate.

Who Oversees Minimum Wage Compliance?

The main authority responsible for monitoring and enforcing wage compliance is the Financial Control of Undeclared Work (Finanzkontrolle Schwarzarbeit – FKS), which operates under Germany’s Customs Authority (Zollverwaltung).

The FKS regularly inspects companies, employers, and contractors to ensure they are:

- Paying at least the statutory minimum wage (€12.82 per hour as of 2025).

- Keeping accurate records of working hours and payment slips.

- Providing proper employment contracts to their workers.

These checks are not limited to large corporations – small businesses, restaurants, construction sites, and cleaning companies are also frequently audited.

What Employers Must Do

To stay compliant with the minimum wage law, employers in Germany must:

- Maintain detailed documentation of all employees’ working hours.

- Provide clear and transparent payslips each month.

- Pay the basic salary in Germany per hour directly into employees’ bank accounts (not cash, to ensure traceability).

- Display or make accessible information on employee rights related to minimum wage.

Failure to comply with these requirements can lead to serious legal and financial consequences.

Penalties for Violating Minimum Wage Laws

Germany enforces one of the strictest penalty systems in Europe for wage-related offenses.

Here’s what can happen if employers break the rules:

| Type of Violation | Penalty or Consequence |

| Paying below the legal minimum wage | Fines up to €500,000 |

| Failure to maintain work hour records | Fines up to €30,000 |

| Obstructing inspections by authorities | Fines up to €30,000 |

| Repeated or severe violations | Possible criminal charges and bans from public contracts |

These strict penalties reflect Germany’s zero-tolerance approach toward unfair labor practices.

Future Outlook for Wages in Germany (2026–2027)

Germany is planning significant reforms in wage monitoring and regional compensation alignment. The scheduled increases to €13.90 in 2026 and €14.60 in 2027 reflect the country’s post-inflation recovery policies and commitment to living wage goals.

Discussions are ongoing about introducing region-based wage tiers to accommodate cost-of-living differences between Bavaria, Berlin, and Saxony.

Conclusion

The minimum wage in Germany ensures fair pay and protection for all employees, including full-time workers, part-timers, and international students. As of 2025, the basic salary in Germany per hour is €12.82 for all full-time and part-time workers, forming a reliable baseline for earnings.

While gross salary is higher, deductions for taxes and social contributions mean the take-home pay is slightly lower – but still sufficient to cover living expenses in most cities. Most workers are covered by the law, though exceptions like apprentices, voluntary interns, and the self-employed exist. For international students, part-time jobs and internships provide a legal way to earn at least the minimum salary in Germany per month while gaining valuable experience. Strict enforcement and penalties ensure employers comply with the germany pay rate per hour, protecting workers’ rights.

FAQs

What is the minimum wage in the Germany in 2025?

€12.82 per hour or approximately €2,222 per month gross.

Will the minimum wage rise again?

The Minimum Wage Commission recommended increases to €13.90 (2026) and €14.60 (2027); governments typically follow or adapt these recommendations. Monitor official publications and ministry orders for final legal enactment.

How does Germany compare to other EU countries?

Germany’s wage ranks among the top four in Europe, behind Luxembourg and the Netherlands.

Does the minimum wage apply to foreign workers and posted workers?

Yes – employees working in Germany under German employment law are covered. Posted workers are subject to rules and sometimes special sectoral minimums under EU posting rules; compliance checks are frequent.

Related Post

Cost of living in Germany

Average salary after masters in Germany

Jobs and salary after MBA in Germany

Germany student visa rejection reasons