Studying in the United States of America (USA) continues to be one of the most sought-after dreams for students worldwide – especially from India. With world-class universities, cutting-edge research facilities, and global career opportunities, the USA attracts thousands of aspiring students every year. The landscape of international education in 2026 has undergone a paradigm shift. With the implementation of the One Big Beautiful Bill Act (OBBBA) in the United States and the Budget 2026 updates in India, financing a degree in the US requires a more nuanced approach than ever before. In 2026, an Education Loan for USA is no longer just a funding option but a structured financial strategy aligned with global career outcomes.

Key highlights: Education Loan for USA

- Why Do Indian Students Need Education Loans?

- The 2026 Market Outlook: What has Changed?

- Estimating the ‘Total Cost of Attendance’ (TCoA) in 2026

- Types of Education Loans for the USA

- Comparative Analysis of Top Lenders

- Eligibility and Documentation Requirements

- Section 80E: The Government is Your Silent Partner

- The Strategic Edge of USD-Based Loans: Avoiding the “Double-Loss”

- The Interest Rate “Lottery” (8.65% to 19%)

- The Application Process: Roadmap

- Cost Example & EMI Calculation

- Smart Repayment & Loan Optimization Strategies (2026 Edition)

- ROI Analysis: Is Education Loan for USA Worth It in 2026?

- Why Education Loans Get Rejected in 2026 (And How to Avoid It)

- Post-Graduation Risk Planning (OPT, H-1B & Worst-Case Scenario)

- Conclusion

- FAQs

Want to Study in Europe?

Start your journey with Successcribe’s free expert guidance

Book a Free Session NowWhy Do Indian Students Need Education Loans?

Studying in the USA often costs between ₹30 lakh to ₹1.5 crore (or more) depending on the institution and course. Many families cannot afford this much liquidity upfront, so loans serve as a bridge to finance:

- Higher education abroad

- Quality education & global exposure

- Professional & career advancement

- Better return on investment in terms of salary & opportunities

The 2026 Market Outlook: What has Changed?

The dynamics of an Education Loan for USA have significantly evolved in 2026 due to regulatory reforms, interest rate shifts, and currency volatility. As of February 2026, the cost of a US education has seen a stabilized but high-plateau growth. The average cost of a two-year Master’s program now ranges between $80,000 and $120,000, including living expenses.

Key Regulatory Changes in 2026

- OBBBA Impact: New federal borrowing caps for US-based borrowers (including those with US cosigners) are now set at $20,000/year for undergraduate and $20,500/year for graduate programs.

- TCS Reduction: For Indian students, the Tax Collected at Source (TCS) on foreign remittances has been slashed from 5% to 2% in the 2026 Union Budget, providing significant upfront liquidity.

- Interest Rate Volatility: While federal rates for the 2025-26 cycle are fixed at 6.39% for Undergrads and 7.94% for Grads, private lenders are offering competitive variable rates starting from 3.89%.

Suggested Post: Entrepreneurship courses and universities in USA

Estimating the ‘Total Cost of Attendance’ (TCoA) in 2026

Before applying for an Education Loan for USA, students must carefully evaluate the complete Total Cost of Attendance, including tuition, living, and insurance. The “I-20 amount” is no longer just a number; it is a financial benchmark.

| Program Type | Public University (Out-of-State) | Private University |

| MBA / Business | $45,000 – $65,000 | $60,000 – $95,000 |

| Engineering / STEM | $35,000 – $50,000 | $50,000 – $75,000 |

| Data Science / AI | $40,000 – $55,000 | $55,000 – $85,000 |

| Humanities / Arts | $25,000 – $40,000 | $40,000 – $60,000 |

Regional Monthly Living Expenses

| City Category | Monthly Cost (USD) | Popular Cities |

| Tier 1 (High) | $2,800 – $4,200 | New York, San Francisco, Boston |

| Tier 2 (Moderate) | $1,800 – $2,600 | Chicago, Atlanta, Austin |

| Tier 3 (Affordable) | $1,200 – $1,700 | Indianapolis, St. Louis, Raleigh |

Types of Education Loans for the USA

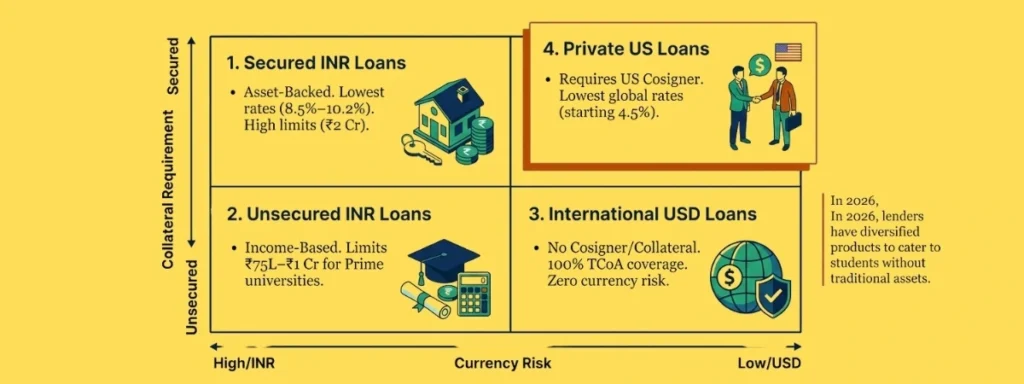

Understanding different types of Education Loan for USA options – secured, unsecured, USD-based, and cosigner-backed – is critical for selecting the right funding structure. In 2026, lenders have diversified their products to cater to students without traditional assets.

1. Secured Education Loans (Asset-Backed)

This remains the most traditional and cost-effective route for families with tangible assets. In 2026, Indian public sector banks (PSBs) have streamlined their digital portals, making this once-tedious process significantly faster.

- Collateral Types: Residential houses, non-agricultural land, Fixed Deposits (FDs), or Government Bonds.

- Key Advantage: Lowest interest rates (typically 8.5% – 10.2%) and the highest sanction limits (up to ₹2 Crore).

- 2026 Update: Banks like SBI and Bank of Baroda now offer “Pre-Admit Sanctions,” allowing you to show proof of funds to universities even before receiving a formal admit letter.

- Best For: Students targeting high-cost MBA or Medical programs who have family-owned property and want to minimize long-term interest outflow.

2. Unsecured Education Loans (Income-Based)

This category has seen the most growth in 2026, driven by AI-based underwriting that assesses your “future earning potential” rather than just your current assets.

- Mechanism: Lenders evaluate the ranking of your US university, your GRE/GMAT scores, and the co-applicant’s CIBIL score/income.

- Lenders: Leading NBFCs (Credila, Avanse, Auxilo) and Private Banks (ICICI, IDFC First).

- 2026 Update: The limit for unsecured loans has been pushed to ₹75 Lakhs – ₹1 Crore for “Prime” US universities (Ivy Leagues, Top 50 STEM schools).

- Best For: STEM and Data Science students with strong academic backgrounds but no property to pledge.

3. International USD-Denominated Loans

With the US Dollar remaining strong against the Rupee in 2026, borrowing in USD has become a strategic move to hedge against currency devaluation.

- The Logic: You borrow in USD and repay in USD from your future US salary. This eliminates the risk of the Rupee falling further during your 2-year study period.

- No-Cosigner Model: Lenders like MPOWER Financing and Prodigy Finance do not require a co-applicant or collateral. They fund you based on your “Career Path.”

- 2026 Update: These lenders now cover 100% of the Total Cost of Attendance (TCoA), including high-end health insurance and tech expenses (laptops/software).

- Best For: Independent students or those whose parents are retired and cannot act as traditional co-signers.

4. Private US Student Loans (with US Cosigner)

If you have a relative who is a US Citizen or Green Card holder with a high credit score, this is the “Golden Ticket” of student financing.

- Features: These loans offer the lowest interest rates in the world (starting as low as 4.5% – 6% variable).

- Lenders: Sallie Mae, SoFi, and Citizens Bank.

- 2026 Update: Under new 2026 regulations, “Cosigner Release” options have become more transparent, allowing your US relative to be removed from the loan after you make 24 consecutive on-time payments.

- Best For: Students with immediate family in the US who are willing to back their credit

| Feature | Secured (INR) | Unsecured (INR) | International (USD) |

| Typical ROI | 8.5% – 10.5% | 10.75% – 13% | 9.99% – 14.5% |

| Max Amount | Up to ₹2 Cr | Up to ₹1 Cr | Up to $100,000+ |

| Co-signer | Required | Mandatory | Not Required (for some) |

| Processing Time | 15 – 25 Days | 5 – 10 Days | 3 – 5 Days |

| Tax Benefit | Full 80E Benefit | Full 80E Benefit | None in India |

| Currency Risk | High (Rupee Volatility) | High | Zero |

Comparative Analysis of Top Lenders

In 2026, the market for education loans to the USA has matured into a highly competitive space where fintech lenders and traditional banks are fighting for student mindshare. The “best” lender is no longer just the one with the lowest rate, but the one whose disbursement and repayment terms align with your post-graduation career path. Choosing the right lender for your Education Loan for USA requires comparing interest rates, processing time, currency risk, and repayment flexibility.

Top International Fintech Lenders (No Collateral / No Cosigner)

These lenders are the primary choice for students who want financial independence. They use Predictive Analytics to assess your future earning potential based on your university and major.

| Feature | MPOWER Financing | Prodigy Finance |

| Best For | Predictability & STEM/Business | Top 100 Global Universities |

| Interest Type | Fixed (9.99% – 13.99%) | Variable (Benchmark + Margin) |

| Loan Currency | USD | USD / Multi-currency |

| Processing Fee | 5% (Capitalized) | 5% (Admin fee) |

| Max Amount | Up to $100,000 | Up to 100% of TCoA |

| USP | Free Visa Support & Career Prep | Access to 1,100+ Schools |

Indian Nationalized & Private Banks (Traditional Support)

For students with a strong Indian co-applicant and property, Indian banks offer the security of the RBI framework and significant tax savings.

| Lender | SBI (Global Ed-Vantage) | Credila | IDFC FIRST Bank |

| Type | Secured (Collateral) | Specialized NBFC | High-Growth Private Bank |

| Interest Rate | 9.25% – 10.5% | 10.25% – 12.5% | 9.5% – 11.5% |

| Max Amount | ₹1.5 Crore | ₹2 Crore+ | ₹1 Crore (Unsecured) |

| Processing Fee | Flat ₹10,000 + GST | 1.0% – 1.5% | Flat ₹5,000 – ₹10,000 |

| Grace Period | Course + 6 Months | Course + 12 Months | Course + 12 Months |

What to look for?

- The “Real” Cost: APR vs. Interest Rate

In 2026, many students fall for low interest rates while ignoring high processing fees. Always check the Annual Percentage Rate (APR), which includes:

- Standard Interest

- Processing/Admin Fees

- Required Insurance Premiums

- Foreign Exchange Margins (for INR loans)

- Disbursement Timelines (The I-20 Factor)

US Universities now require proof of liquid funds within 48-72 hours of your admission to issue the I-20 form.

- Fintechs (MPOWER/Prodigy): Provide a digital “Visa Support Letter” instantly.

- Indian Banks: May take 7-10 days to issue a formal Sanction Letter.

- Currency Risk Hedge

With the USD/INR exchange rate fluctuating, a 1% shift can add thousands of dollars to your debt.

- USD Loans (MPOWER/Prodigy) carry zero currency risk because you borrow and earn in the same currency.

- INR Loans (SBI/HDFC) benefit from the Section 80E tax deduction, which can effectively reduce your interest rate by 2-3% if your co-applicant is in a high tax bracket.

Suggested Post: Exams required to study in USA

Eligibility and Documentation Requirements

Here is the Core Eligibility Criteria:

- Nationality: Most Indian banks require the applicant and co-applicant to be Indian citizens.

- Admission: Confirmation of acceptance from a recognized university for a full-time professional/technical course is mandatory.

- Academic Record: A strong academic history and valid scores in standardized tests (GRE, GMAT, TOEFL, IELTS, SAT).

- Age: Typically 18 years or older; otherwise, parents must apply on the student’s behalf.

Essential Document Checklist

| Category | Documents Required |

| Academic | Mark sheets (10th, 12th, Graduation), Entrance exam results, Offer Letter. |

| KYC | PAN Card, Passport (mandatory for study abroad), Aadhaar Card, Voter ID. |

| Financial (Co-applicant) | Last 6 months’ bank statements, Salary slips, IT Returns (Form 16), Asset-Liability Statement. |

| Property (if secured) | Sale deed, Title deeds, Approved plan blueprint, Land tax receipts. |

| Other | I-20 form (for USA), Scholarship letters, Fee structure breakup. |

Critical Loan Parameters and Considerations

Moratorium Period

This is a grace period (repayment holiday) during which the student is not required to make principal repayments.

- Duration: Generally lasts for the course duration plus 6 to 12 months.

- Interest during Moratorium: Lenders may charge Simple Interest (SI) or Partial Simple Interest (PSI). SBI adds accrued interest during this period to the principal for EMI calculation.

Margin Money

The portion of the educational cost that the student must fund from their own resources.

- Public Banks: Usually require 10% to 15% margin for studies abroad.

- Private Lenders/NBFCs: Often offer 0% margin (100% financing).

- Scholarships: Can often be adjusted against the margin requirement.

Section 80E: The Government is Your Silent Partner

One of the most compelling reasons to choose a loan over “self-funding” with family savings is Section 80E of the Income Tax Act. The Indian government provides a significant tax deduction on the interest portion of an education loan.

- No Upper Limit: Unlike other tax-saving instruments, there is no cap on the amount of interest you can deduct from your taxable income. For a ₹1 crore loan, this can result in massive tax savings for the student or co-applicant.

- The 8-Year Window: This benefit is available for up to 8 years, effectively lowering the “real” cost of your loan to well below the nominal interest rate.

The Strategic Edge of USD-Based Loans: Avoiding the “Double-Loss”

If you plan to work in the US post-graduation via OPT or an H-1B visa, borrowing in US Dollars (USD) is a masterstroke of financial hedging. Taking an Indian Rupee (INR) loan exposes you to a “double-loss”: the high inflation rates in India and the consistent depreciation of the Rupee against the Dollar.

A USD-denominated loan allows you to earn in Dollars and pay in Dollars, eliminating the “hassle factor” and the currency conversion fees that eat into your monthly budget.

The Interest Rate “Lottery” (8.65% to 19%)

Your university ranking is your strongest currency in a loan negotiation—use it. Lenders categorize institutions from “AAAA+” to “A,” and your rate is directly tied to this rating.

- Public Bank Ranges: SBI Global Ed-Vantage rates typically range from 8.65% to 11.75%, while Union Bank of India ranges between 9.25% and 9.75% for listed premium universities.

- The Collateral Benefit: Pledging 100% collateral can reduce your interest rate by up to 200 basis points (2%), saving you lakhs over a 15-year tenure.

- The Moratorium Advantage: Most public and private lenders offer a “Repayment Holiday” or Moratorium Period, which covers the duration of your course plus an additional 6 months to 1 year.

Speed is also a new variable; while traditional banks may take a month, fintechs like Leap Finance now offer loan sanctions in as little as 3 days, providing the agility needed for tight visa deadlines.

The Application Process: Roadmap

In 2026, the application process has shifted from a “paper-heavy” marathon to a “digital-first” sprint. With the integration of AI-driven verification and the new US Visa Integrity Fee ($250), timing is everything. Applying early for an Education Loan for USA ensures faster I-20 issuance, smoother visa processing, and better negotiation leverage.

Phase 1: The “Digital Alpha” (12–10 Months Before)

Before you even receive an admit, you must build your “Financial Persona.”

- Profile Evaluation: Lenders now use AI to scan your LinkedIn, GRE scores, and university choices. Ensure your digital academic footprint is clean.

- Credit Health Check: Fix any minor defaults in your or your co-applicant’s credit score. In 2026, a score below 720 can lead to an instant digital rejection.

- The “Pre-Admit” Sanction: Apply for a conditional loan approval. This 2026-standard letter acts as “Proof of Intent” and speeds up your I-20 issuance by weeks.

Phase 2: Admission & The I-20 Sprint (6–4 Months Before)

Once you have your offer letter, the clock starts ticking for the I-20 (Certificate of Eligibility).

- Proof of Funds (The 1-Year Rule): You must show the university that you have liquid funds for exactly one year as listed on their fee structure.

- The “Sanction to I-20” Bridge: Submit your loan sanction letter to the University’s International Office.

In 2026, many US universities (like USC and NYU) now require a “Bank Attestation” alongside the loan letter. Ensure your lender provides this.

- SEVIS Payment: Once you get your I-20, pay the $350 SEVIS Fee immediately. The 2026 portal is now linked directly to the visa scheduling system.

Phase 3: The 2026 Visa “Integrity” Protocol (3 Months Before)

The US Visa process in 2026 has added layers of security and fee structures.

- DS-160 Filing: Be 100% consistent. If your loan is for $60,000, but you tell the officer it’s for $50,000, the AI-flagging system will cause a delay.

- The Fees – MRV Fee: $185

New Integrity Fee: $250 (mandatory since Jan 2026)

- Social Media Disclosure: You must now provide your handles for the last 5 years. Ensure your public posts don’t conflict with your “Intent to Return” to your home country.

Phase 4: Disbursement & The “Forex Lock” (1 Month Before)

Don’t just “send the money.” Manage the 2026 market volatility.

- Disbursement Trigger: Most lenders will only release funds after the visa is stamped.

- Direct-to-School: To save on the 2% TCS, ensure the bank transfers tuition directly to the University’s student account via SWIFT/Wire.

- The Forex Card: Get a multi-currency card for your first month’s living expenses. In 2026, many students use Central Bank Digital Currency (CBDC) apps for instant, low-fee transfers from their parents.

Cost Example & EMI Calculation

Let’s assume you take a ₹50 lakh loan at 9.5% interest for 10 years.

| Amount | Value |

| Loan principal | ₹50,00,000 |

| Interest (9.5% p.a.) | ₹4,75,000 per year |

| Approx EMI | ₹66,000 – ₹70,000 per month* |

Smart Repayment & Loan Optimization Strategies (2026 Edition)

Taking an education loan is only half the journey. The real financial intelligence lies in how you repay and optimize the loan after graduation. In 2026, with interest rate volatility and global currency fluctuations, strategic repayment planning can save you ₹5–25 lakhs over the loan tenure.

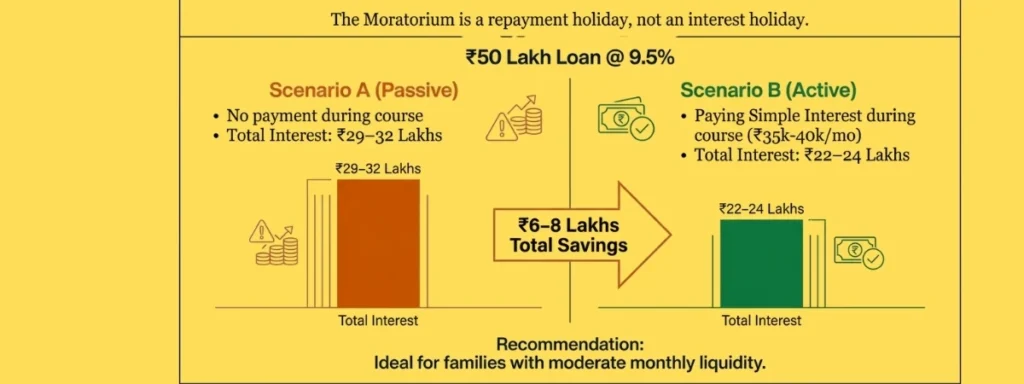

1. Paying Interest During Moratorium (The Hidden Advantage)

Most lenders allow a moratorium period (course duration + 6–12 months). However, interest continues to accrue.

If you choose to pay simple interest (SI) during the study period, you reduce your EMI burden significantly after graduation.

Example Calculation (₹50 Lakh Loan @ 9.5%)

| Scenario | EMI (10 years) | Total Interest Paid | Total Savings |

| No payment during course | ₹66,000–₹70,000 | ₹29–32 Lakhs | – |

| Paying interest during course | ₹58,000–₹61,000 | ₹22–24 Lakhs | ₹6–8 Lakhs |

Ideal for: Families who can manage ₹35k–₹40k monthly during studies.

2. Loan Refinancing in the USA (After Getting a Job)

Once you secure employment (OPT or H-1B), you can refinance your loan with US-based lenders.

Why refinance?

- Lower interest rates (4%–6% for strong credit holders)

- Switch from variable to fixed

- Remove Indian co-applicant liability

| Factor | Before Refinancing | After Refinancing |

| Interest Rate | 9%–11% | 4%–6% |

| EMI (USD) | $1,200 | $850 |

| Tenure | 10 Years | 7–10 Years |

Works best for STEM students earning $85,000+ annually.

3. Prepayment vs Long Tenure Strategy

In 2026, most banks allow zero prepayment penalty (especially public banks).

If you receive:

- Sign-on bonus

- RSUs (Restricted Stock Units)

- Tax refund

- Annual performance bonus

You should consider partial prepayment within first 3–5 years, when interest component is highest.

4. Balance Transfer Strategy

You can transfer your loan from:

- NBFC → Public Bank

- Indian Lender → US Refinance Lender

Potential savings: 1.5%–3% interest reduction

ROI Analysis: Is Education Loan for USA Worth It in 2026?

Before borrowing ₹50 lakh to ₹1 crore, every student must calculate Return on Investment (ROI).

Average 2026 Salary Benchmarks

| Program | Average Starting Salary (USD) | Post-Tax Monthly Income | EMI (USD) | EMI % of Income |

| MS Computer Science | $95,000 | $6,000 | $1,000 | 16% |

| Data Science / AI | $105,000 | $6,500 | $1,100 | 17% |

| MBA (Top 50) | $120,000 | $7,200 | $1,400 | 19% |

| Non-STEM | $65,000 | $4,200 | $900 | 21–23% |

Break-Even Timeline

| Loan Amount | Avg Salary | Years to Recover Investment |

| ₹50 Lakhs | $95k | 3–4 Years |

| ₹80 Lakhs | $120k | 4–5 Years |

| ₹60 Lakhs | $65k | 5–6 Years |

Insight: STEM programs offer the fastest ROI due to OPT extension (3 years)

Why Education Loans Get Rejected in 2026 (And How to Avoid It)

With AI-based underwriting systems in 2026, loan approvals are faster – but rejections are also more algorithm-driven.

Common Rejection Reasons

| Reason | Impact Level | How to Fix |

| CIBIL below 720 | High | Clear credit dues before applying |

| Weak Co-applicant Income | High | Add secondary co-applicant |

| High Debt-to-Income Ratio | Moderate | Reduce existing EMIs |

| Low University Ranking | High | Apply to lender-approved list |

| Property Title Issues | High | Use legally clear asset |

| Inconsistent ITR filings | High | Maintain 2–3 years clean returns |

Post-Graduation Risk Planning (OPT, H-1B & Worst-Case Scenario)

An education loan is a commitment. You must prepare for all outcomes.

OPT & Work Window

| Category | OPT Duration |

| Non-STEM | 12 Months |

| STEM | 36 Months |

This gives STEM students longer repayment stability.

What If You Don’t Get a Job Immediately?

Options in 2026:

- Request EMI restructuring

- Extend tenure

- Switch to interest-only repayment temporarily

- Refinance in India if returning

Worst-Case Scenario Planning

Before borrowing:

- Keep 6 months emergency fund

- Avoid borrowing beyond I-20 requirement

- Choose flexible repayment lender

- Consider longer tenure for safety

Impact of Default

If EMI is unpaid:

- Co-applicant CIBIL drops immediately

- Secured loan may trigger SARFAESI action

- Visa future applications may be affected

Conclusion

Navigating the financial landscape of 2026 requires more than just a signature on a loan document; it requires a strategic mindset. With the introduction of the OBBBA and the shift toward AI-driven lending, the “perfect” loan is no longer just about the lowest interest rate – it’s about flexibility, tax efficiency, and currency hedging. Ultimately, an Education Loan for USA is not a liability but a leveraged investment when aligned with employability, repayment strategy, and currency management. Whether you choose a secured Indian bank loan to leverage Section 80E benefits or an international USD loan to eliminate currency risk, your education loan is the fuel for your global career. By understanding the 2026 regulatory changes – from TCS reductions to Integrity Fees – you are already ahead of the curve.

FAQs

Is it better to take a loan in INR or USD in 2026?

This depends on your long-term plan:

1. Choose INR if you have a co-signer in a high tax bracket who can maximize Section 80E tax deductions (which effectively slashes your interest rate).

2. Choose USD if you plan to work in the US post-graduation. It eliminates the “Currency Depreciation Risk” (the risk of the Rupee falling while you study).

Can I get 100% education loan without collateral?

Yes, in certain cases.

1. NBFCs and private banks offer unsecured loans up to ₹1 crore.

2. International lenders like MPOWER and Prodigy Finance fund up to 100% of Total Cost of Attendance (TCoA).

3. Approval depends on university ranking, course, and co-applicant income (if required).

However, interest rates are typically higher than secured loans.

What is the moratorium period for education loans?

Most lenders offer:

1. Course duration + 6 months (Public Banks)

2. Course duration + 12 months (NBFCs)

3. Some USD lenders require interest-only payments during study

Interest continues to accrue during this period unless partially paid.

Can I change my co-signer or “release” my property after I graduate?

Yes, through Refinancing. Once you have a US job and a 6-month credit history (FICO score), you can refinance your Indian loan with a US lender. This pays off the Indian bank in full, releasing your parents’ income liability and their property collateral.

What is the minimum CIBIL score required for approval?

For Indian lenders in 2026:

1. 720+ CIBIL score is ideal

2. Below 700 may lead to rejection or higher interest

3. For secured loans, approval chances are higher even with moderate score

USD lenders focus more on university and earning potential rather than CIBIL.

Related Post

Education system in USA

Commerce courses in USA

Profile building bachelors in USA

Bank for international students in USA