Studying in the United States is a life-changing opportunity, but managing finances in a new country can be challenging without the right banking setup. For international students, opening and maintaining a bank account in the USA is not just a convenience – it is a necessity. From paying tuition fees and rent to receiving on-campus salaries and managing daily expenses, a reliable bank account forms the backbone of a student’s financial life in the USA. As of 2026, the United States hosts over 1.15 million international students, making it the world’s top destination for global education.

According to the Institute of International Education (IIE), international students contribute more than USD 40 billion annually to the US economy. With such large financial activity, banks in the USA have developed specialized products tailored specifically for international students. Bank for International Students in USA plays a critical role in shaping a student’s financial stability, daily convenience, and long-term success, making it one of the most important systems international students must understand upon arrival.

Key Highlights: Bank for International Students in USA

- Why International Students Need a Bank Account in the USA

- Understanding the US Banking System (For International Students)

- Categorizing Student-Specific Accounts: Checking, Savings, and Virtual Wallets

- Opening an Account With and Without an SSN

- Top Banks for International Student in 2026

- International Money Transfers to the USA

- Debit Cards, Credit Cards, and Building Credit History

- Common Banking Problems & 2026 Solutions

- Banking Differences by State & Campus Location

- Banking Mistakes That Can Create Visa or Compliance Issues

- Conclusion

- FAQs

Want to Study in Europe?

Start your journey with Successcribe’s free expert guidance

Book a Free Session NowWhy International Students Need a Bank Account in the USA

Opening a US bank account is one of the first and most important steps after landing in the United States.

Key Reasons:

- To pay rent, utilities, and groceries

- To receive scholarships, stipends, or on-campus job salaries

- To pay tuition and university fees

- To avoid high foreign transaction fees

- To build a US credit history

- To use digital payment systems (Zelle, Venmo, Apple Pay, etc.)

Without a US bank account, students often rely on international debit cards, which can cost USD 3 – 7 per transaction plus currency conversion charges of 2 – 4%, leading to significant losses over time.

Understanding the US Banking System (For International Students)

Understanding how the Bank for International Students in USA operates – including national banks, regional institutions, and digital-only banks – allows students to make informed decisions that align with their lifestyle and financial goals. The US banking system is divided into three major categories:

- National Banks

Operate across multiple states (e.g., Chase, Bank of America)

- Regional & Community Banks

Limited to specific states or cities

- Online/Digital Banks

No physical branches (e.g., Chime, Discover, Wise)

Key Feature of US Banking:

- Most accounts are fee-based

- Overdrafts are allowed but charge fees

- Debit cards are widely used instead of cash

- Checks are still common for rent and tuition

Suggested Post: Best states in USA for international students

Categorizing Student-Specific Accounts: Checking, Savings, and Virtual Wallets

Specialized “Student Accounts” are the gold standard for F-1 and J-1 visa holders.

Selecting the right account type within a Bank for International Students in USA – whether checking, savings, or virtual wallets – helps students balance daily spending, savings discipline, and smart budgeting in a new financial environment. These accounts are engineered to bypass traditional hurdles like high monthly maintenance fees and restrictive minimum balances.

- Checking Accounts: These provide the necessary daily liquidity. In 2026, look for “checkless” options if you prefer to avoid the risks of physical check fraud.

- Savings Accounts: These serve as interest-bearing vaults. Typical minimum balances to waive fees in standard savings accounts range from $300 to $2,400 (equivalent to 25,000–200,000 INR).

- Virtual Wallets: Models like PNC’s Virtual Wallet are high-value tools for mobile-first students. They integrate “Spend” (checking) and “Reserve” (savings) functions into a single interface, providing visual budgeting tools to prevent overspending.

Choosing the right account type is your first tactical decision before gathering regulatory documentation.

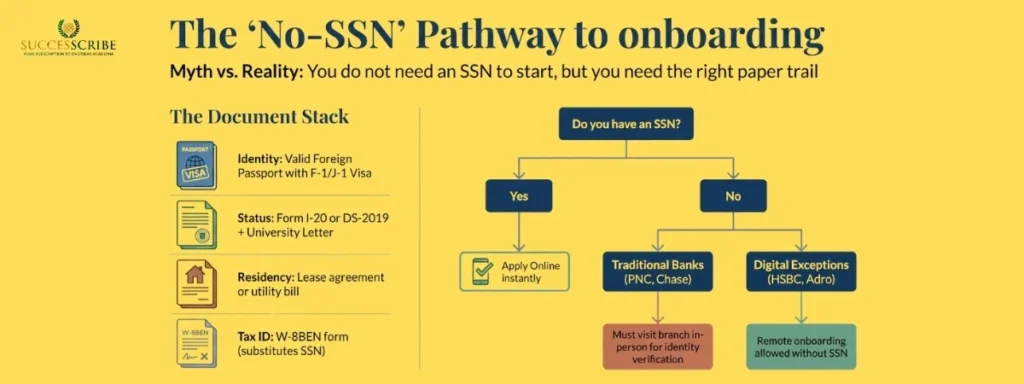

Opening an Account With and Without an SSN

The regulatory shift in 2026 has increased inclusivity for international students. While a Social Security Number (SSN) is helpful, it is no longer a prerequisite for many major institutions.

Mandatory Documents for F-1/J-1 Holders

| Document Category | Requirement |

| Identity | Valid Foreign Passport with F-1/J-1 Visa. |

| Status Verification | Form I-20 or DS-2019; University Acceptance/Enrollment Letter. |

| U.S. Residency | Lease agreement, utility bill, or official university housing letter. |

| Tax Identification | SSN (if available) or W-8BEN Form / Foreign Tax ID (FTIN). |

The “No-SSN” Pathway: Major players like Chase and Bank of America accept alternative identification. Strategic Nuance: While many banks allow online applications for those with an SSN, students without one often must apply in person. For instance, PNC Bank requires an in-person visit for non-U.S. persons without an SSN to verify secondary IDs, such as a student ID or foreign driver’s license.

Top Banks for International Student in 2026

Leading institutions under the Bank for International Students in USA category now provide tailored products, zero-fee accounts, multilingual support, and SSN-free onboarding designed specifically for global students. The following banks offer the most comprehensive services for international students, with specific features designed to accommodate those without Social Security Numbers (SSN).

- Chase Bank: Best for accessibility. Offers a $100 bonus for new student accounts and access to 16,000+ ATMs.

- Bank of America: Advantage SafeBalance is excellent for students under 25, offering a $0 monthly fee and high-tier mobile budgeting.

- Wells Fargo: “Clear Access Banking” is a checkless account that eliminates overdraft fees – perfect for those new to the U.S. system.

- HSBC: The leader for pre-arrival. Allows you to open a U.S. account from your home country and view global balances in one app.

- PNC Bank: Virtual Wallet provides a high-tech interface and call support in over 240 languages.

- TD Bank: “TD Complete” offers specialized perks for ages 17-23, including waived non-TD ATM fees.

- Capital One: The “360 Checking” account is fee-free with no minimums and a massive 70,000+ ATM network.

- Adro/Wise/Zolve: These “Digital-First” specialists are best for students moving money frequently across borders with mid-market exchange rates.

| Bank | Min Deposit | Monthly Fee | SSN Required? |

| Chase | $25 | $0 (for 5 years) | No (w/ Alt ID) |

| Bank of America | $25 | $0 (Under 25) | No |

| Wells Fargo | $25 | $0 (Ages 17-24) | Often (Varies) |

| Capital One | $0 | $0 | No |

| PNC | $25 | $0 (Ages <25) | No (In-person) |

| HSBC | $25 | $0 (for 6 years) | No |

| TD Bank | $0 | $0 (Ages 17-23) | No |

| Wise/Adro | $0 | $0 | No |

International Money Transfers to the USA

In 2026, the process of moving large sums – such as tuition and living expenses – has moved away from slow, expensive bank wires toward “Direct-to-Institution” portals and Real-Time Rails. Understanding the difference between these methods can save you between $800 and $2,500 per year in exchange rate markups and intermediary fees.

The 2026 Transfer Ecosystem

The landscape is currently split into three main channels, each serving a different purpose for the international student:

- Education Payment Gateways (Flywire, Convera)

Most US universities now partner with specialized gateways. When you log into your student portal to pay tuition, you are often redirected here.

- How it works: You pay in your local currency to a local account in your home country; the gateway then settles the USD amount with the university.

- 2026 Feature: Rate Locking. These platforms now allow you to “freeze” an exchange rate for 48-72 hours, protecting you from market volatility while you arrange the funds.

- Digital Remittance Platforms (Wise, Niyo, Revolut)

Ideal for monthly living expenses and rent. In 2026, these platforms have integrated with the FedNow system, meaning a transfer initiated in London or Mumbai can hit a US bank account in under 20 seconds.

- The “Real” Rate: Unlike banks, these platforms use the Mid-Market Rate (the one you see on Google) and charge a transparent, upfront fee.

- Traditional SWIFT Wires

The legacy system used by major banks. While secure for “ultra-large” transfers (e.g., $50,000+), it remains the most expensive due to Intermediary Bank Fees.

- The “Hidden” Cost: Even if your home bank says the fee is $20, “correspondent banks” along the chain often deduct an additional $15–$50 before the money reaches your US account.

Comparison: The Cost of Sending $20,000 USD

| Method | Avg. Exchange Markup | Flat Fees | Total Cost (Est.) | Speed |

| Traditional Bank | 3.5% | $45 + Intermediary | $750 – $800 | 3 – 5 Days |

| Flywire / Convera | 1.5% – 2% | Included | $300 – $400 | 2–3 Days |

| Wise / Revolut | 0.4% – 0.7% | $15 – $30 | $95 – $170 | Instant to 24hrs. |

| Niyo (Specialized) | 0% – 0.5% | $0 Platform Fee | $60 – $100 | 12 – 48 hours |

Regulatory Compliance: LRS and TCS in 2026

For students from countries like India, the Liberalized Remittance Scheme (LRS) remains a critical factor.

- Tax Collected at Source (TCS): As of 2026, if your transfer is funded via an Education Loan, the TCS is a minimal 0.5% (above a specific threshold). If funded by personal savings, this can jump to 5% or more, though this is usually refundable when you file your tax returns.

- Purpose Codes: Always ensure your transfer is marked with the correct 2026 purpose code (e.g., S0305 for Education) to ensure lower tax rates and faster clearance by the central bank.

New for 2026: The “Visa Integrity Fee” & Remittance Tax

- Visa Integrity Fee: Be aware that starting in 2026, the US government has added a $250 fee for many student visa categories, which must be paid via specific authorized channels (often via SEVIS).

- Excise Tax on Cash: A new 1% federal excise tax applies to physical cash-based transfers in the US. To avoid this, always use digital/electronic methods (ACH or Wire) which are exempt from this specific 2026 tax.

Pro-Tips for Saving Money

- Avoid Weekend Transfers: Forex markets close on weekends. Apps often add a “buffer” markup (0.5% – 1%) on Saturdays and Sundays to protect themselves against Monday’s opening volatility.

- Batch Your Transfers: Instead of sending $1,000 every month, send $3,000 every quarter. You will save significantly on the fixed “Inbound Wire Fees” charged by your US bank (usually $15–$30 per hit).

- Check for “No-Fee” Corridors: Some banks (like HSBC or Citibank) offer free global transfers if you hold accounts with them in both your home country and the USA.

Debit Cards, Credit Cards, and Building Credit History

In 2026, the distinction between “spending” and “building” money has become a cornerstone of student life. While a debit card handles your immediate needs, your credit card is a strategic tool for your future in the USA.

Debit Card Usage in the USA

Debit cards issued by a Bank for International Students in USA are optimized for contactless payments, digital wallets, and cashless campuses, ensuring seamless everyday transactions. As of early 2026, the US has moved almost entirely to “Contactless First” payments.

- Digital Wallet Integration: Over 95% of international students in 2026 use Apple Pay, Google Pay, or Samsung Pay. Your physical debit card is rarely swiped; it is usually “tapped” or stored in a digital wallet.

- Online Security: Most 2026 student accounts include “Virtual Card” features. You can generate a temporary card number for one-time online purchases, ensuring your main account remains safe from hackers.

- The “No-Cash” Norm: Physical cash is increasingly rare on US campuses. In 2026, many university cafes and bookstores have moved to “Cashless Only” models for speed and safety.

Student Credit Cards: Your Entry Point

A student credit card is an “unsecured” card designed for those with no income history. In 2026, these cards are highly competitive.

| Card Name (2026) | Best Feature | 2026 Rewards | SSN Required? |

| Capital One Savor Student | Dining & Streaming | 3% Cash Back | No (ITIN/Passport ok) |

| Discover it® Student | Grade Rewards | Cashback Match (Yr 1) | No (ITIN ok) |

| Chase Freedom Rise® | Ease of Approval | 1.5% Flat Rate | No (ITIN ok) |

| Deserve EDU | Amazon Prime Perk | 1 Year Prime Student | No (No SSN/ITIN) |

Secured Credit Cards: The “Safety Net” Card

If you are denied a student card, a Secured Credit Card is your next best step.

- How it Works: You provide a refundable deposit (e.g., $300). That deposit becomes your credit limit.

- 2026 Upgrade Path: Most 2026 secured cards (like those from Bank of America or Capital One) automatically review your account after 6 months. If you’ve paid on time, they return your deposit and “graduate” you to a standard card.

How to Build a US Credit Score from Zero

The US credit system (FICO) is a mathematical representation of how much a bank can trust you. In 2026, follow the “15-30-100” Rule:

- Keep Utilization under 15%: If your limit is $1,000, never let your balance exceed $150.

- Spend 30% of your time monitoring: Use free apps like Credit Karma (integrated with most 2026 bank apps) to check for errors.

- 100% On-Time Payments: A single late payment in 2026 can drop your score by 50–100 points instantly.

Common Banking Problems & 2026 Solutions

Even with the best planning, international students often hit “financial friction.” Here is how to navigate the most common 2026 hurdles.

Account Freezes (The “Fraud Flag”)

Banks in 2026 use AI-driven fraud detection. A sudden $5,000 transfer from your home country can trigger an automatic freeze.

- The Fix: Always “Notify of Large Inbound Transfers” via your bank’s app 48 hours before the money is sent.

- Resolution: If frozen, call the “Identity Verification” department immediately. Have your I-20 and Passport ready for a video-call verification (standard in 2026).

Hidden Fees

| Fee Type | 2026 Cost | The “Student Hack” |

| Monthly Maintenance | $12.00 | Ensure “Student Status” is updated every year. |

| Foreign Transaction | 3% | Use a “Travel-Specific” card (like Revolut) for trips home. |

| Paper Statement Fee | $2.50 | Go 100% digital in your app settings. |

| Inactivity Fee | $5.00 | Set up one $5 monthly subscription (like Spotify) to keep it active. |

Overdraft Issues: The 2026 “Safe Mode”

An overdraft occurs when you spend more than you have. Historically, this cost $35 per event.

- 2026 Standard: Most student accounts now feature “Overdraft Prevention.” Instead of charging a fee, the bank simply declines the transaction.

- Warning: Ensure “Overdraft Protection” (which pulls from a linked credit card) is turned off, as this often carries high interest rates.

ATM Network Limitations

While the US has millions of ATMs, using one that doesn’t belong to your bank is expensive.

- The Cost: In 2026, you may pay $3.00 to the ATM owner AND $3.00 to your own bank.

- The Solution: Use the “Cash Back” feature at major grocery stores (like Target or Walmart). When you buy a pack of gum, select “Cash Back” on the terminal; it is usually free and uses the grocery store’s secure system.

Banking Differences by State & Campus Location

While major banks operate nationwide, the student banking experience in the USA varies significantly by state and city. International students often underestimate how campus location affects ATM access, branch availability, and even customer support quality.

Why State-Level Banking Matters

- Some universities are located in college towns with limited branch presence

- ATM availability impacts out-of-network withdrawal fees

- Regional banks often offer better student perks than national ones

Best Banks by Popular Study Destinations

| State / Region | Recommended Banks | Why They Work Best |

| California | Chase, Bank of America | High ATM density near UC & private campuses |

| New York | Chase, TD Bank | Branches near universities, extended hours |

| Texas | Chase, Wells Fargo | Strong regional infrastructure |

| Midwest (Illinois, Ohio, Michigan) | PNC, US Bank | Campus-focused regional dominance |

| East Coast (Boston, DC) | TD Bank | Weekend & late-evening banking |

| Small College Towns | Capital One, Online Banks | Limited physical branches |

Over 42% of international students now rely on one physical bank + one digital bank to balance convenience and accessibility.

Banking Mistakes That Can Create Visa or Compliance Issues

Improper usage of a Bank for International Students in USA, such as unexplained transactions or outdated tax forms, can lead to account restrictions and compliance reviews. Even unintentional mistakes can trigger compliance reviews.

High-Risk Banking Errors to Avoid

- Large unexplained cash deposits

- Frequent peer-to-peer transfers flagged as “business activity”

- Using personal accounts for freelancing income

- Ignoring FATCA / W-8BEN updates

Banks now use AI-based transaction monitoring. Sudden irregular activity can lead to temporary account freezes pending identity verification.

Conclusion

A well-structured Bank for International Students in USA setup empowers students to manage money efficiently, remain visa-compliant, build credit, and focus on academic and professional success. For international students, banking in the United States is no longer a simple administrative task – it is a strategic foundation that directly impacts academic life, financial stability, and long-term opportunities. In 2026, with over 1.15 million international students contributing more than USD 40 billion annually to the US economy, banks have evolved to offer highly specialized, student-centric financial ecosystems that go far beyond basic checking accounts.

FAQs

Can international students open a bank account in the USA without an SSN?

Yes. In 2026, most major US banks allow international students on F-1 and J-1 visas to open a bank account without a Social Security Number (SSN). Banks such as Chase, Bank of America, Capital One, PNC, TD Bank, HSBC, Wise, Zolve, and Adro accept alternative documentation like a passport, visa, Form I-20 or DS-2019, and a university enrollment letter. Students without an SSN may be required to visit a branch in person for identity verification.

Which bank is best for international students in the USA in 2026?

The “best” bank depends on individual needs, but in 2026:

!. Chase is best for nationwide ATM access

2. Bank of America is ideal for students under 25

3. Capital One 360 is best for zero-fee banking

4. HSBC is excellent for pre-arrival account setup

5. PNC Virtual Wallet is best for budgeting tools

6. Wise, Zolve, and Adro are best for international transfers

Many students use one physical bank + one digital bank for maximum flexibility.

What documents are required to open a US bank account as an international student?

Typically required documents include:

!. Valid foreign passport with US visa (F-1 or J-1)

2. Form I-20 or DS-2019

3. University admission or enrollment letter

4. Proof of US address (lease, utility bill, or housing letter)

5. SSN (if available) or W-8BEN / Foreign Tax ID

Document requirements may vary slightly by bank and state.

How long does it take to open a bank account in the USA?

Most bank accounts are opened the same day when applying in person. Debit cards usually arrive within 5–7 business days. Digital banks may provide a virtual debit card instantly, allowing students to start spending immediately while the physical card is delivered.

Is it better to open a US bank account before arriving in the USA?

Yes, if possible. Banks like HSBC and platforms like Zolve allow students to open accounts before arriving in the US. This enables students to receive money, pay initial expenses, and avoid carrying large amounts of cash upon arrival.

Related Post

Profile building bachelors in USA

Bachelor of science in USA

Exams required to study in USA

Executive MBA in USA